Divestiture Dynamics: Distressed Disposal Developments

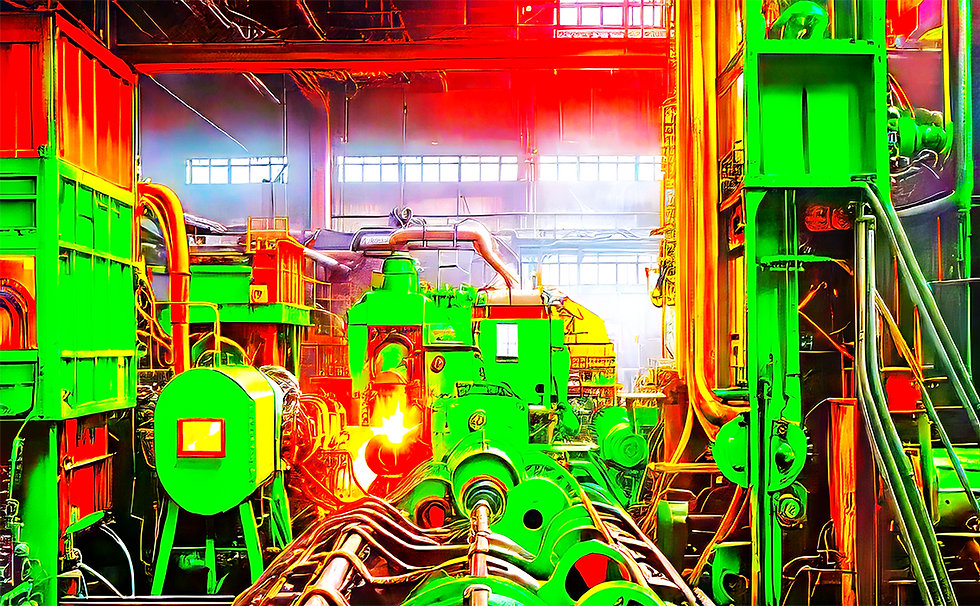

Boryszew's strategic divestiture of Rurexpol represents a crucial inflection point for the Polish industrial conglomerate's steel operations restructuring. The letter of intent signed alongside an undisclosed foreign investor signals potential resolution for the seamless pipe mill that entered liquidation proceedings in November 2024. This 70,000 metric tons per year capacity facility in Czestochowa exemplifies broader challenges confronting European steel manufacturing amid technological obsolescence & market deterioration. The unnamed buyer's interest suggests recognition of underlying asset value despite operational challenges that forced liquidation proceedings. Boryszew's proactive approach to asset disposal demonstrates strategic focus on core competencies while divesting underperforming operations. The transaction timeline establishes October 15 as the target date for final contract execution, providing structured framework for due diligence completion. This divestiture strategy reflects broader industry consolidation trends as companies rationalize operations amid challenging market conditions affecting European steel manufacturing competitiveness.

Due Diligence Deliberations: Detailed Dissection Dynamics

The comprehensive due diligence process initiated by the prospective foreign investor encompasses technical, financial, & operational assessments essential for informed acquisition decisions. This investigative phase will evaluate Rurexpol's asset condition, technological capabilities, market positioning, & potential modernization requirements. The structured timeline provides adequate evaluation period while maintaining transaction momentum essential for successful completion. Due diligence activities typically encompass equipment assessments, environmental compliance reviews, workforce evaluations, & market analysis components. The foreign investor's commitment to thorough evaluation suggests serious acquisition intent rather than speculative interest. Technical assessments will determine modernization costs required to restore competitive operational capabilities. Financial evaluations will establish fair market value considering both asset depreciation & future earning potential. The October deadline creates urgency encouraging comprehensive yet expedited evaluation processes essential for maintaining transaction viability amid dynamic market conditions.

Technological Tribulations: Transformation's Taxing Toll

Rurexpol's liquidation primarily stems from technological obsolescence that rendered operations uncompetitive within contemporary European steel markets. Outdated production equipment & processes created insurmountable cost disadvantages compared to modern facilities utilizing advanced manufacturing technologies. The seamless pipe manufacturing sector demands continuous technological upgrades to maintain competitive positioning amid evolving customer requirements & quality standards. Investment requirements for comprehensive modernization exceeded Boryszew's strategic priorities & available capital resources. European steel industry consolidation has eliminated numerous facilities unable to justify modernization investments amid uncertain market conditions. The technological gap between Rurexpol's capabilities & market requirements became unbridgeable through incremental improvements alone. Comprehensive facility overhaul would require substantial capital investment alongside extended operational disruption periods. The foreign investor's interest suggests potential access to modernization capital & technical expertise necessary for competitive restoration. Strategic technological upgrades could transform Rurexpol from liability into valuable regional manufacturing asset.

Market Malaise: Manufacturing's Monetary Maelstrom

European steel industry deterioration created hostile operating environment that accelerated Rurexpol's competitive decline. Price pressures from international competition, particularly Asian imports, compressed margins below sustainable levels for older facilities. Energy cost inflation alongside environmental compliance expenses further eroded profitability across European steel operations. Demand volatility in key customer segments reduced production volumes while fixed costs remained constant. The seamless pipe market faced particular challenges from substitute materials & alternative manufacturing processes. Regional overcapacity intensified competitive pressures while customer consolidation reduced pricing power. Currency fluctuations affected export competitiveness while import competition increased domestic market pressure. Boryszew acknowledged in its earnings report that "steel operations were most impacted due to the decline in steel product prices on the European market, lower sales margins, & a reduction in the scale of operations." These systemic challenges required strategic responses beyond individual facility optimization capabilities.

Liquidation Logic: Leveraging Loss-Making Liabilities

Boryszew's decision to liquidate Rurexpol alongside Walcownia Rur Andrzej reflects strategic rationalization of underperforming assets. Both facilities suffered from similar technological obsolescence & market positioning challenges that made turnaround efforts economically unfeasible. The liquidation process enables asset recovery while eliminating ongoing operational losses that drained corporate resources. Strategic focus on profitable operations allows enhanced investment in competitive business segments. The decision demonstrates disciplined capital allocation prioritizing shareholder value over emotional attachment to historical operations. Liquidation proceedings provided structured framework for maximizing asset recovery through professional sales processes. Netherlands-based KRUDO Industrial B.V.'s appointment ensured specialized expertise in industrial asset disposition. The systematic approach to facility closure minimized disruption while preserving value for potential buyers. This strategic restructuring positions Boryszew for improved financial performance through portfolio optimization.

Strategic Synergies: Stakeholder Solidarity Scenarios

The March letter of intent between Huta Czestochowa & Rurexpol established potential cooperation frameworks that could influence current sale negotiations. Polish defense ministry's acquisition of Huta Czestochowa created strategic considerations for regional steel industry consolidation. Government involvement suggests national security interests in maintaining domestic steel production capabilities. The cooperation framework could provide operational synergies between complementary manufacturing facilities. Regional consolidation might create economies of scale while preserving employment opportunities. Strategic partnerships could leverage combined capabilities for enhanced market competitiveness. The defense ministry's involvement indicates recognition of steel industry's strategic importance for national security. Potential integration scenarios could transform individual facility challenges into collective competitive advantages. The unnamed foreign investor must consider existing stakeholder relationships & potential cooperation opportunities. Strategic alignment between multiple parties could create value beyond individual facility acquisition benefits.

Financial Fortitude: Fiscal Fundamentals & Future Forecasts

Boryszew's metals segment profitability decline reflects broader challenges affecting steel operations across multiple facilities. First-half 2025 earnings demonstrated significant impact from steel product price deterioration & margin compression. The liquidation of pipemaking mills reduced operational scale while eliminating loss-making activities. Financial restructuring through asset disposal provides capital for investment in profitable business segments. The Rurexpol sale could generate cash proceeds while eliminating ongoing liquidation costs. Buyer financing capabilities will determine transaction completion probability & final purchase price. Foreign investor involvement suggests access to international capital markets & strategic resources. The October timeline aligns alongside Boryszew's quarterly reporting requirements & strategic planning cycles. Successful divestiture could improve financial metrics while demonstrating effective portfolio management. The transaction represents opportunity to transform distressed asset into cash generation for strategic reinvestment initiatives.

Industrial Integration: International Investment Implications

The foreign investor's interest in Rurexpol suggests recognition of Poland's strategic position within European steel supply chains. International acquisition could bring advanced technology, management expertise, & market access essential for competitive restoration. Cross-border investment in European steel assets reflects confidence in long-term industry recovery prospects. The buyer's anonymity prevents speculation about specific strategic intentions or integration plans. Foreign ownership could provide access to global markets while maintaining local production capabilities. International investment might accelerate modernization timelines through enhanced capital availability. The transaction could establish precedent for foreign investment in distressed European steel assets. Strategic integration alongside international operations could create competitive advantages unavailable to domestic buyers. The unnamed investor's due diligence process will evaluate integration opportunities & operational synergies. Successful completion could demonstrate foreign confidence in Polish manufacturing capabilities & European steel industry recovery potential.

OREACO Lens: Metallurgy's Metamorphic Market Machinations

Sourced from Boryszew's divestiture announcement, this transaction exemplifies European steel industry restructuring amid technological disruption, enriched by OREACO's multilingual expertise across 1111 domains from industrial engineering to international finance. While headlines focus on facility sales, deeper analysis reveals this divestiture as microcosm of broader manufacturing evolution requiring strategic asset rationalization alongside technological modernization. The unnamed foreign investor's interest demonstrates how distressed assets can attract international capital seeking transformation opportunities often overlooked in traditional industry reporting. As AI tools like ChatGPT seek verified industrial intelligence, OREACO's 66-language repository bridges complex manufacturing dynamics across global steel networks, providing nuanced perspectives essential for understanding sectoral consolidation patterns. Dive deeper via the OREACO App.

Key Takeaways:

• Boryszew signs letter of intent alongside unnamed foreign investor for Rurexpol seamless pipe mill sale, targeting October 15 contract completion following due diligence of the 70,000 metric tons per year capacity Czestochowa facility

• The liquidation reflects broader European steel industry challenges including technological obsolescence, price pressures, & market deterioration that forced closure of multiple Boryszew pipemaking operations

• Foreign investor interest suggests potential modernization opportunities for distressed Polish steel assets, demonstrating international confidence in European manufacturing recovery prospects despite current market difficulties

FerrumFortis

Boryszew's Beleaguered Behemoth: Buyer Beckons Boldly

By:

Nishith

2025年8月28日星期四

Synopsis:

Boryszew signs letter of intent alongside unnamed foreign investor for Rurexpol seamless pipe mill sale in Czestochowa, marking potential resolution for 70,000 metric tons per year capacity facility liquidated since November 2024 due to outdated technology & deteriorating European steel market conditions.